Ascend is a financial planning and investment service for high-income early and mid-career professionals whose portfolio has not yet reached $1 million.

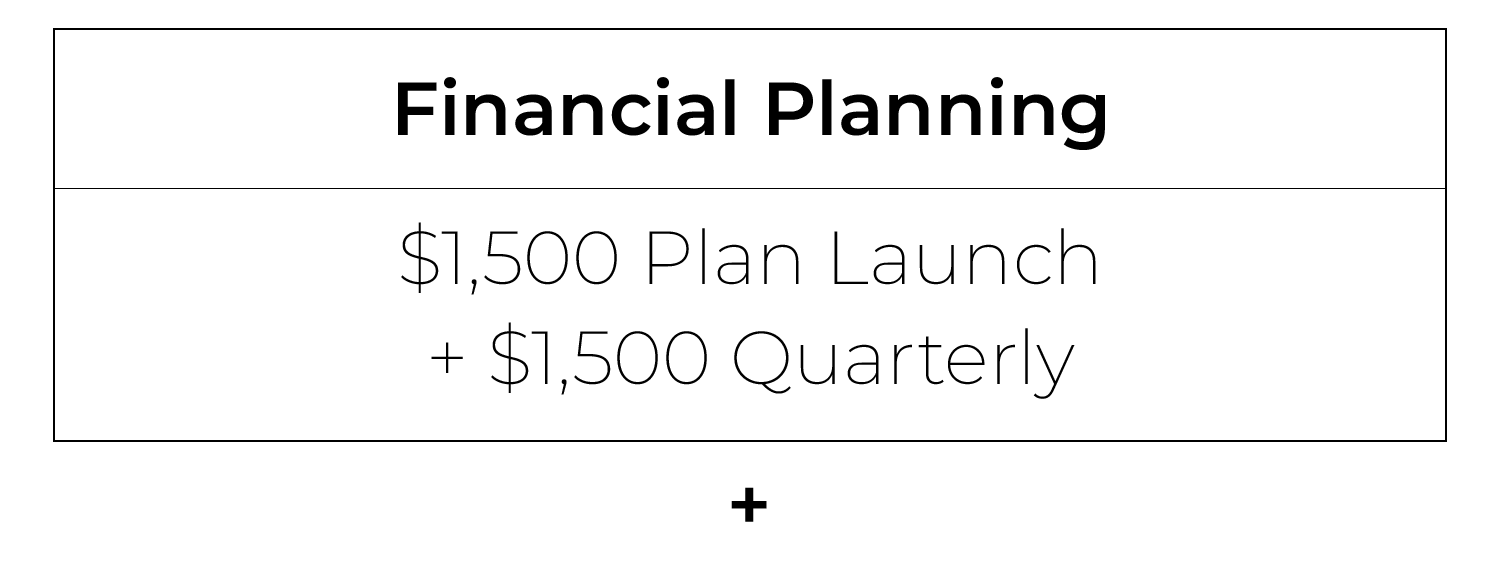

Financial Planning

Know how today’s decisions impact tomorrow so you can move forward with confidence and peace of mind. Our team will be by your side for every step.

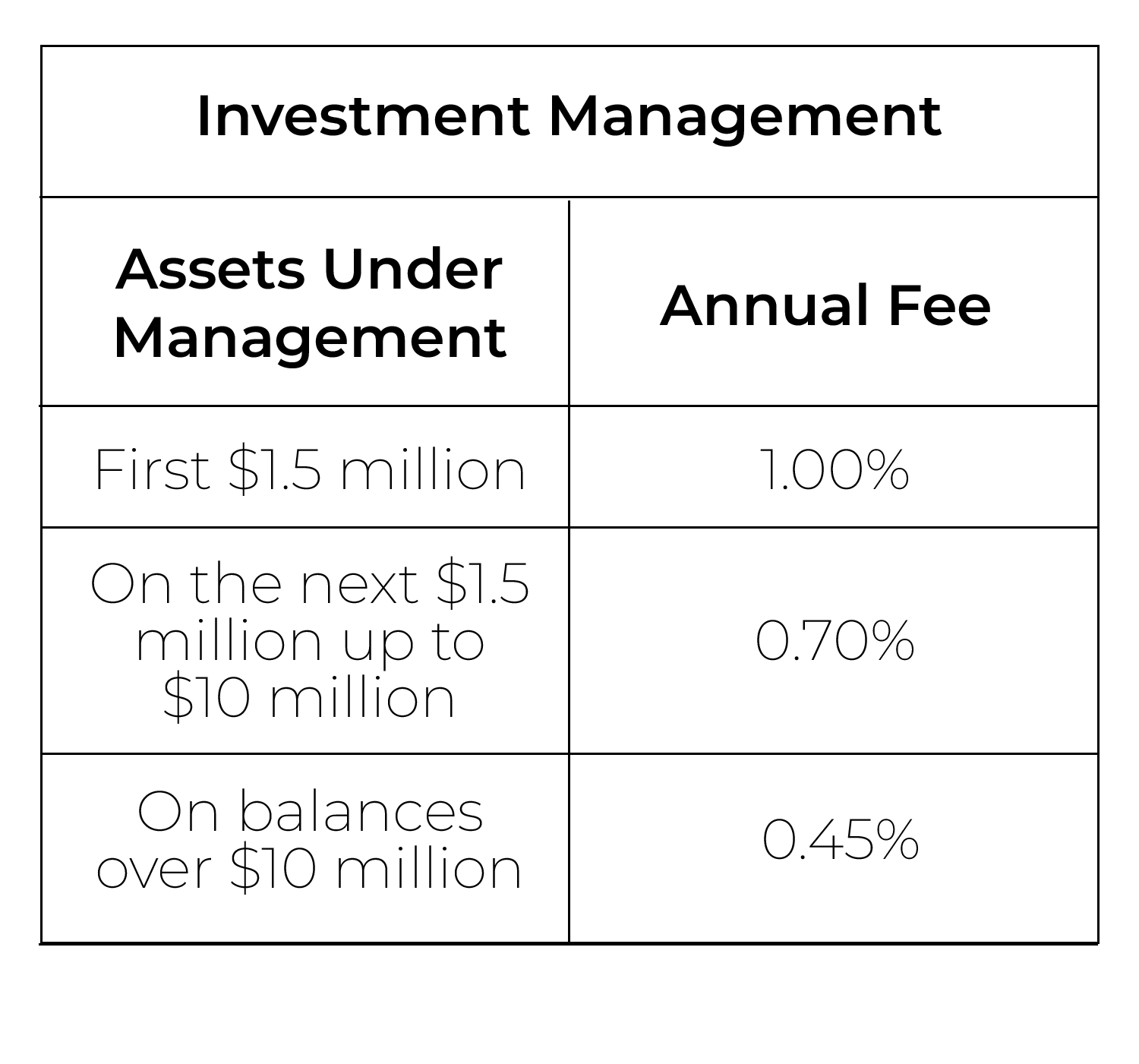

Investment Management

With a proactive and tech-forward approach, we nurture a portfolio that is driven by your objectives, values, legacy goals, and tax planning needs.

Network of professionals

We work directly with other financial experts, such as accountants and estate attorneys, to create a unified approach to your financial health.

Making a difference

Hilltop Wealth Advisors’ Wealth Management service is designed to help preserve and grow the wealth of:

✓ Young Professionals & families

✓ Student loan borrowers

✓ employees with equity awards

✓ medical professionals

✓ small business owners

✓ Working women

Pricing

We are fee-only, so we do not receive any commissions for selling products.

LESS THAN $1M

Your fee has two parts:

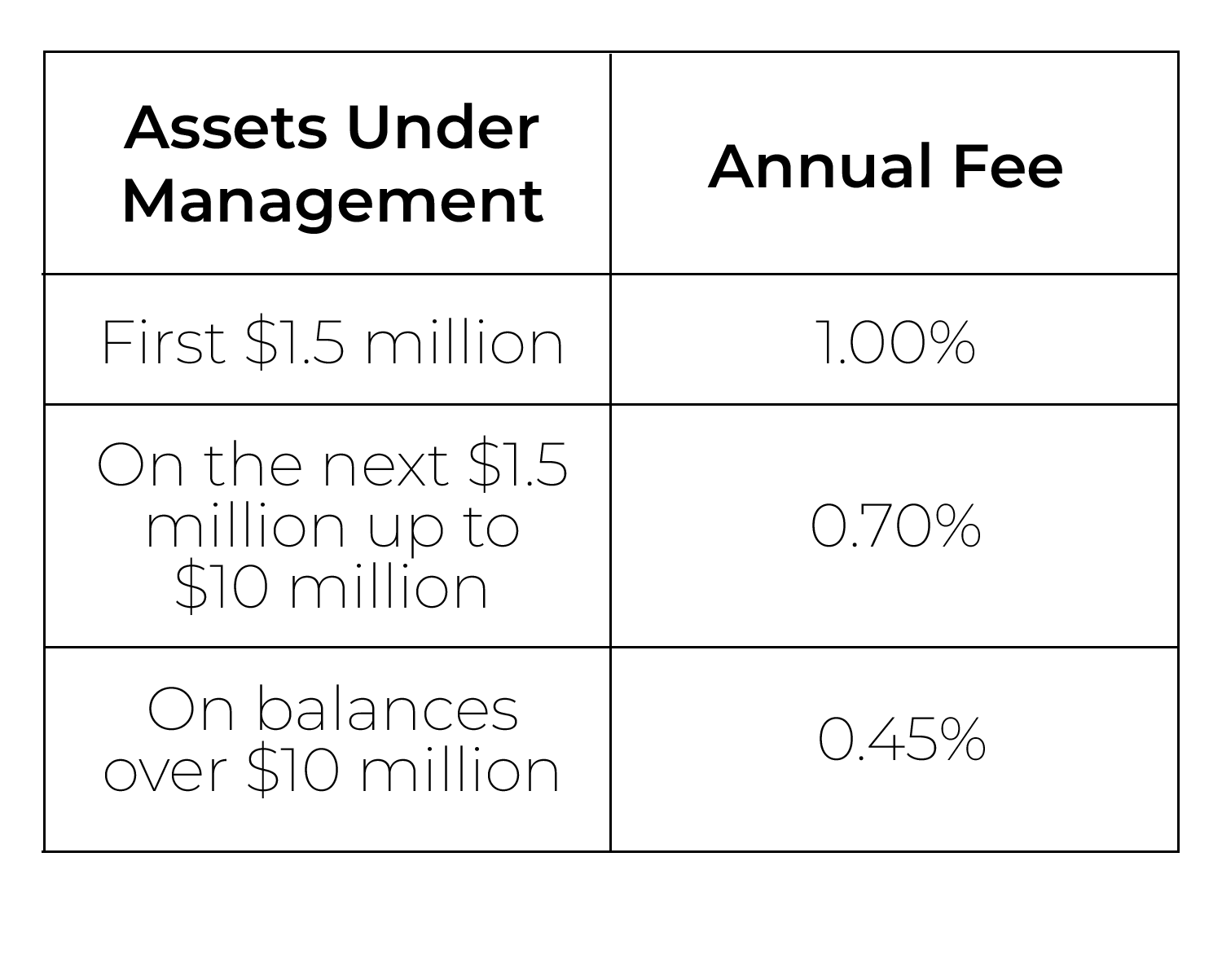

$1M OR MORE

Your fee is a % of the accounts we manage:

Minimum Quarterly Fee: $3,750

There is no required contract length. For more details, click here to view our Form ADV Part 2A - Firm Brochure.

Executive Advantage

Executive Advantage

Hilltop Wealth Advisors specializes in retirement

and wealth strategies for executives of Cisco, Duke Energy, Duke Health, Duke University, Google, GSK, IBM, IQVIA, and SAS. Learn more about our Executive Advantage solutions for 401k plans, investment management, tax minimization, and more:

YOUR TRUSTED FINANCIAL ADVISOR

“I love seeing how small decisions can have a big long-term impact”

Brittany Brinckerhoff is our trusted financial advisor for Ascend clients. Get to know Brittany by reading her bio.

GETTING STARTED

INTRO CALL

We have a brief, complimentary phone call to get to know each other, explore whether we are a good fit, and answer any initial questions.

DATA GATHERING

Before we give advice, we discuss your goals and use our secure portal to gather relevant information.

STRATEGy

Hilltop Wealth Advisors works with you to create a personal action plan that addresses your top priorities and identifies any other needs.

ONGOING REVIEW

We schedule regular meetings to monitor your strategy and address unexpected events in your life.

SCHEDULE

-

In our first meeting each year, we will help you reaffirm your priorities and measure progress toward your goals. This meeting typically covers:

▶ Reviewing and updating goals

▶ Net worth and cash flow

▶ Savings and investment strategies

▶ Stress test scenarios

▶ Gifting strategies

-

In our summer meeting, we will help you understand and prepare for different financial risks and will typically cover:

▶ Risk management and insurance planning

▶ Your estate plan

▶ Legacy planning strategies

-

In our final meeting of the year, we will review your income tax situation and consider strategies to manage what you owe:

▶ Reducing current-year taxes

▶ Minimizing future taxes

▶ Pertinent tax code updates

▶ Collaboration with your tax advisor

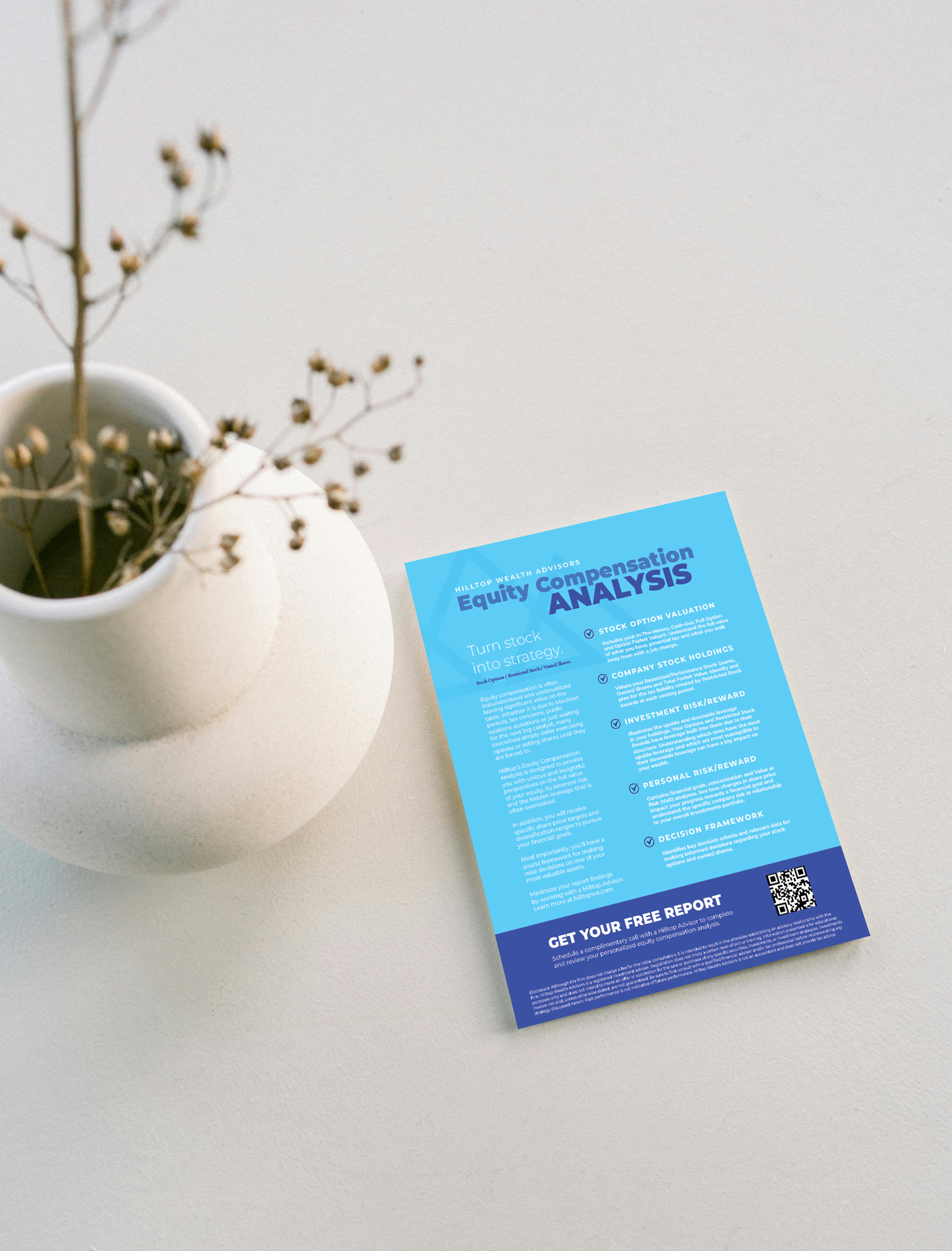

Have Equity Compensation?

Make wise decisions about one of your most valuable assets with Hilltop’s Equity Compensation Analysis. Designed to provide you with unique and insightful perspectives on the full value of your equity, its inherent risk, and the hidden leverage often overlooked in your stock options to help you reach your financial goals.