Monte Carlo Simulation: Planning for Uncertainty to Make Wiser Decisions (Part 2 of 2)

By Chris Hostetler

Financial decision making would be much easier if you could boil it down to a simple math problem. Unfortunately, the real world is unpredictable – many factors in the financial planning formula are random and uncontrollable. So how can you make wise decisions when you cannot control everything?

We discussed this already in our previous post, titled “Monte Carlo Simulation: Planning for Uncertainty to Better Understand Your Financial Future.” (The rest of this post will make much more sense if you’ve already read Part 1, so we’ll stay right here if you want to go read that one first.)

In that previous post, we explored how a Monte Carlo simulation can help you understand the wide range of possible outcomes you face due to a number of variables, particularly investment returns and inflation. Now we’ll discuss what you actually do with that information.

At Hilltop Wealth Advisors, we run Monte Carlo simulations for our clients using the eMoney Advisor financial planning software, which runs 1,000 trials of a plan scenario. With each trial demonstrating a different mix of market and inflation results, we get two primary outputs: Asset Spread and Probability of Success.

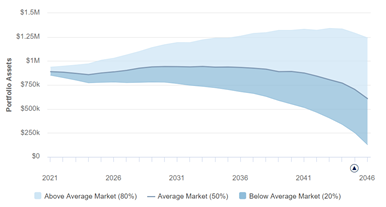

The Asset Spread shows a likely range of portfolio values at your date of death (a date way in the future that we’ve just picked for planning purposes). Specifically, the Asset Spread shows how your financial plan fares in the middle 20%-80% of the 1,000 trials mentioned earlier. In other words, it shows how much money you’ll leave behind in 60% of the trials.

This of course leaves 40% of the trials that are outside the projected range: 20% are better and 20% are worse. But this result, the middle 60%, can give you a realistic vision of how much money you’re likely to have at your death (assuming you continue on the same trajectory of income, living expenses, etc.)

The Probability of Success is a simple percentage, showing how many of the trials end with you having at least $1.

Although every plan is different, here is how we would typically respond to your Probability of Success.

<80% - You may need to make adjustments now, depending on your time horizon.

It could make sense to reduce your spending or giving, find opportunities to increase income (a second job or a later retirement date), identify tax saving strategies, etc.

Between 80%-99% - You’re in the sweet spot!

Most outcomes are going to end well for you, but there are a few trials where you run out of money. You should make a game plan for adjustments that you could make if your investment returns are less than optimal.

We know what you’re thinking - having your plan fail 20% of the time doesn’t seem like a good result, but know that the worst-case scenarios assume that you see a poor sequence of investment returns AND you never make any lifestyle adjustments or changes to your financial goals.

100% - You could do more with your money.

We might encourage you to do more of what you’re passionate about, whether it’s to travel more extravagantly, give more generously to charity, or give to family members who could use support now (vs when you die). If you feel like you might have the inclination to hoard your money, we would suggest that you consider intentionally being more generous (or spendy) now with the understanding that you can always adjust your plan if you face a few years of disappointing investment returns.

Many of our clients are overachievers, and their tendency is to try to get a result of 100%. This may be OK, if you are particularly risk-averse and a top score helps you sleep better at night.

A Monte Carlo simulation gives you the benefit of viewing your plan through 1,000 lenses vs one. This can result in a richer understanding of your future and help you better prepare for twists and turns.

If you’re doing financial planning, you’re already ahead of the game. We believe that people with a plan in place are much better prepared to deal with financial surprises. In just the past two decades, we’ve experienced the dot-com bubble bursting, the financial crisis of 2008, a global pandemic, and more.

If you’d like to feel more prepared when the next disaster hits us, review your plan with a financial advisor who is comfortable talking about uncertainty.

Disclaimers

This material is provided as a courtesy and for educational purposes only. Please consult your investment professional, legal or tax advisor for specific information pertaining to your situation.

Asset allocation and diversification do not assure or guarantee better performance and cannot eliminate the risk of investment loss.

Hilltop Wealth Advisors does not provide tax advice. The tax information contained herein is general and is not exhaustive by nature. Federal and state laws are complex and constantly changing. You should always consult your own legal or tax professional for information concerning your individual situation.