With a little planning, there are still ways to benefit from a charitable deduction. One particularly useful strategy gaining popularity under the new tax law is gifting through a Donor Advised Fund (DAF).

Read MoreChris Hostetler and David Wise summarize Hilltop’s updates on the economy and the markets from our latest quarterly investment review. We discuss recent market volatility, the trade war, and more.

Read MoreFor most people, dying is a more visceral fear, so we tend to focus our anxiety and worry on the possibility of death. But facing a period of disability without the proper insurance in place is a serious risk. If you lose income because you’re too sick or injured to work, the financial cost to you and your family can be devastating.

Read MoreRusty Eriksen and David Wise summarize Hilltop's updates on the equity and income markets, including thoughts on recent conversations with clients.

Read MoreIf you want to build a legacy that includes more than your personal and financial assets, the good news is you can easily send the right messages using an ethical will. Sometimes also called a “legacy letter”, an ethical will is any message that shares your personal values with your loved ones after you are gone.

Read MoreYou’ve mastered the basic differences between a Traditional and a Roth IRA (by reading part one of this post) and you’re ready to start saving. Now, it’s game time: which type of account should you use? There’s no right or wrong answer, but there are a few items you should think through before making your decision.

Read MoreYou’re a saver, and you’ve heard that contributing to a Traditional or Roth IRA is a good tax move. But you may be bewildered about the difference and trying to decide which one is for you. We’re here to help! This post is part one of two and will discuss the rules of Traditional and Roth IRAs.

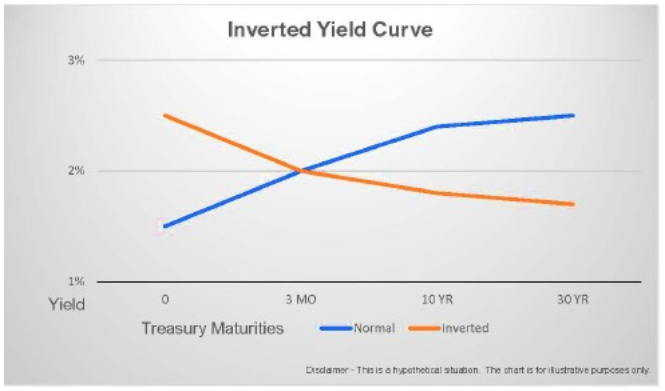

Read MoreAn inverted yield curve has a high correlation as a leading indicator for recessions. So far, the inversion lasted for only a few days; it could be just a blip, relatively meaningless. In fact, 10-year Treasuries have begun offering a higher yield already this week on optimism over a possible trade deal between the US and China.

Read MoreBudgeting does not have to be difficult or time-consuming. It can actually be comforting to know that you have a plan for your money, especially if that includes a regular Starbucks run!

Read MoreChris Hostetler and Ben Yeager summarize Hilltop's updates on the equity and income markets, including thoughts on US economic strength, Brexit negotiations, US-China trade negotiations, the Fed's interest rate policy and more.

Read MoreIf you’re a business owner, Congress has already prepared an exciting ‘gift’ for you, as part of the Tax Cuts and Jobs Act of 2017: a shiny new business tax deduction. For those who qualify, properly taking advantage of these new tax rules may result in substantial tax savings.

Read MoreHappiness comes more from a grateful heart than it does from having all the things you want, because when you get those things you’ll only want more. It’s one thing to say you should feel thankful, but the amazing thing about gratitude is that you can train yourself to do it. And if you train yourself to be grateful, you’re going to make the world a better place for yourself and everybody around you.

Read MoreBen Yeager and Rusty Eriksen provide a summary view of our investment committee’s latest research, sharing our thoughts on market volatility, interest rates and international markets.

Read MoreAs a young professional, you may think you’re too busy to learn how your tax return works. Whether you’re new to adulting and filing on your own for the first time or you’ve been filing for a few years and want to actually understand it this time, you don’t need to be intimidated by the 1040.

Read MoreWith a long-term view of tax planning, the goal is to reduce tax payments over time, not necessarily this year. It might actually make sense to pay a little extra now if it means you can save more money later. One of the best ways to do this is with a Roth conversion.

Read MoreYou've got your water, bread and flashlights ready to go, but what about the documents you may need in case of an emergency? I never recommend panicking, but a little preparation now can save you headaches later. Avoid the paper chase by using our handy document checklist.

Read MoreThe reason your cash reserve is so important: you can never predict when your car is going to break down, when you might lose your job or when you’ll need to take a trip to Urgent Care. These surprise expenses can be costly, and you don’t want to be forced to withdraw from your retirement accounts or take on credit card debt just to pay the bills.

Read MoreChris Hostetler and David Wise provide a summary view of our investment committee’s latest research.

Read MoreAs financial advisors, we always encourage our clients to complete their estate documents, but it wasn’t until this year that I experienced first-hand just how important it is to follow through after the legal documents are drafted. Executing the documents is just the beginning. Where most people fall short is the implementation, which can be easily overlooked.

Read MoreThe new tax code may mean you need a new strategy for giving. Depending on your personal tax situation, you might want to consider “bunching”: making two years’ worth of gifts in one year. This strategy could work if you make substantial gifts but still land just below your standard deduction threshold.

Read More