Providing Your Financial Data

The Hilltop Wealth Portal is two powerful tools in one:

Your personal wealth management platform: review your net worth, investment values, and other financial details in one place.

A financial planning platform: your Hilltop advisor will help you build financial strategies and track your progress toward financial goals.

To prepare for your initial Data Gathering meeting or our annual Goal Tracking appointment, please log in to the portal and follow the steps below.

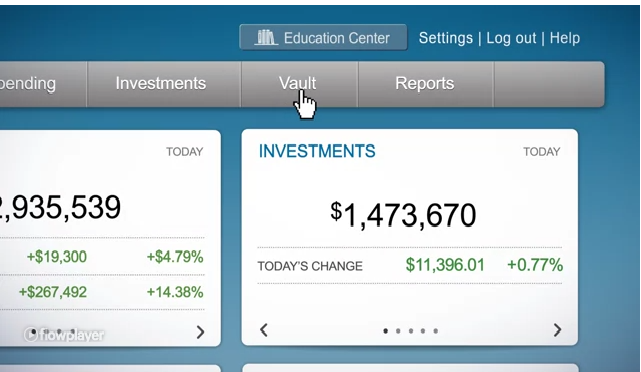

You may also watch a video tutorial by clicking on the image below each section.

STEP 1: ADD CONNECTIONS FOR YOUR NON-HILLTOP FINANCIAL ACCOUNTS

On the portal's home page, in the Accounts section, select the “+ Add” button. Account types include:

Checking and savings

Credit cards

Liabilities (e.g. mortgage, home equity line, auto loan, etc.)

Any other investments (e.g. brokerage, 401(k) plan, etc.)

If you prefer not to add online connections for your accounts, you may enter your balances manually by selecting “I don’t have an online login to this account.”

STEP 2: REVIEW AND UPDATE THE ORGANIZER SECTION

On the home page, click on the Organizer tab at the top of the screen. Review each section, from Accounts to Risk Tolerance, and add or correct information as needed.

For your Annual Living Expenses, found in the Income, Expenses, and Savings section, you have several options:

Skip this step, and we will estimate your spending by reviewing your free cash flow.

Use the “Estimate from Spending” button. This will work only if you have connected your checking and credit card accounts.

Use the “Add Itemized” button to manually enter your spending by category.

Upload spending reports from third-party financial software (e.g. Quicken) to the Vault (see Step 3).

STEP 3: UPLOAD DOCUMENTS TO THE VAULT

On the home page, click on the Vault tab at the top of the screen. Open the Shared Documents folder, and click on the "Upload Files" button. If you have not already provided them to us, please upload the following:

Estate documents (e.g. will, trust documents, power of attorney documents, etc.)

Latest tax return

Latest pay stub

Social Security statement

Latest pension statement

Insurance policy statement